A congressional delegation from the U.S. state of Massachusetts has sent a letter to New York City-based private equity firm Bregal Partners asking the firm to explain how it managed to walk away from over USD 100 million (EUR 93 million) in debts owed to more than 1,000 creditors in the state when it sold now-bankrupt Blue Harvest Fisheries.

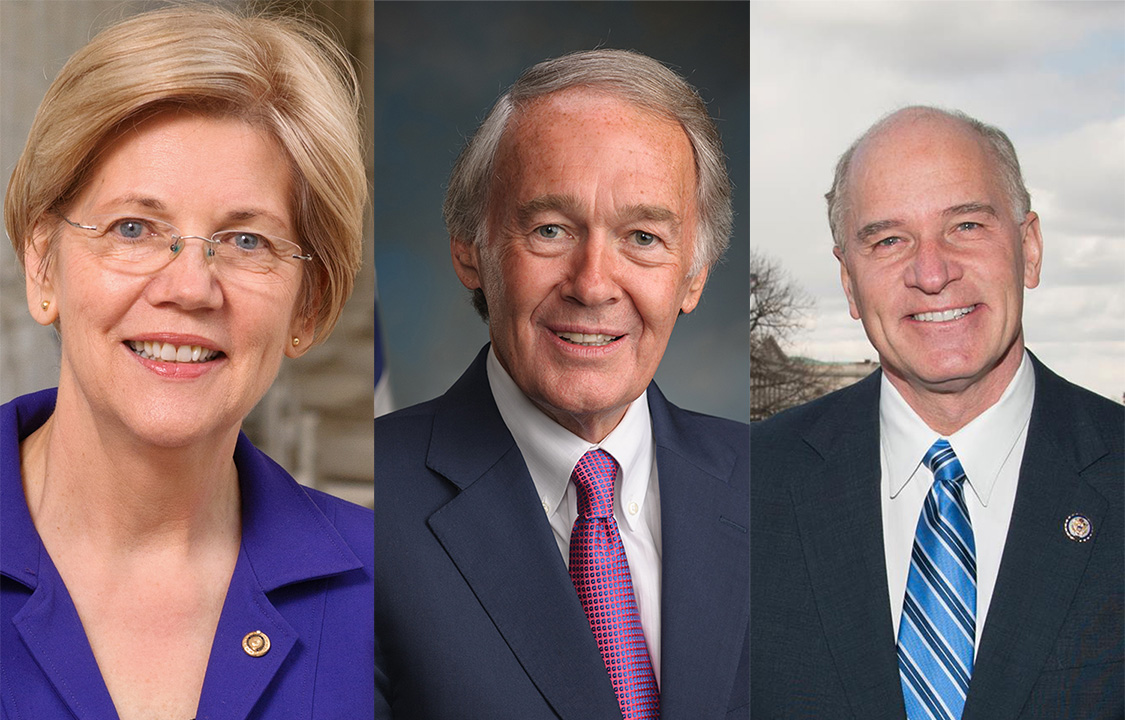

U.S. Sen. Elizabeth Warren and U.S. Sen. Edward Markey, as well as U.S. Rep. William Keating, all Democrats, wrote to the company “to seek information” about the disposition of funds related to Bregal Partners' sale of Blue Harvest, which filed for Chapter 7 bankruptcy protection in September 2023.

Bregal Partners – an investment group owned by the Dutch Drenninkmeijer family – purchased the company in 2015 and then went on an acquisition streak of local seafood companies and facilities before going bankrupt, wiping out many of its creditors and investors.

Since that time, its fishing vessels have been auctioned off to C&P Trawlers for USD 12 million (EUR 11 million), far short of the USD 100 million it owed.

The lawmakers accuse Bregal Partners of stripping the company of assets and value before leaving New Bedford “saddled with its debt.” Those actions took place all while the company treated workers poorly, the letter said.

“As mergers and acquisitions decreased the number of employers in the fishing industry by over 30 percent in the last decade, companies like Blue Harvest demanded longer working hours from fishermen while reducing their income and diverting profits that should have been supporting the local economy,” the lawmakers wrote. “Bregal Partners – the private equity firm that owned 89.5 percent of Blue Harvest – pocketed Blue Harvest’s profits instead.”

Blue Harvest came under fire after a July 2022 ProPublica story highlighted the growing influence of foreign private equity in U.S. fishing interests, and revealed the fact that the company was facing a potential U.S. Department of Justice antritrust probe.

The lengthy report detailed deteriorating working conditions for local fishermen and cited a 2010 rule change as a major driver behind the increase in foreign equity in fishing interests, which allowed companies to lease additional fishing quotas while also making it more difficult to track which company was actually fishing on the quotas.

As it was being accused of treating workers poorly, Blue Harvest was selling off major portions of its valuable scallop fleet to other businesses, which the lawmakers claim was akin to Bregal Partners stripping the company of its assets to net more money.

“Blue Harvest’s claims that none of its ‘property appears to be available to pay creditors’ and that ‘creditors cannot demand repayment’ are inconsistent with the fact that Bregal Partners netted an estimated USD 100 million for itself by selling off assets in the two years prior to declaring bankruptcy,” the lawmakers wrote.

The letter posed several questions for Bregal Partners, including ...

Photo courtesy of the U.S. Congress